In previous posts, I shared some of the data we are collecting at OrthoFi. In a series of blog posts, I hope to share more of the data we have collected from over 60,000 starts and over $300,000,000 in orthodontic production. Today we discuss creating leverage in your business. The Business Dictionary defines leverage as ‘the advantageous condition of having a relatively small amount of cost yield a relatively high level of returns’. Entrepreneur Magazine describes leverage as ‘the key to making what you have go much further. Just like a crowbar or a moving dolly, leverage allows you to harness the power of good positioning and the strategic application of energy to move mountains. Orthodontists typically get itchy thinking about leverage, if they even know what it is. And, to be clear, I have only recently come to truly understand this concept thanks to my exposure to very smart ‘real’ business people. Leverage is a very powerful business concept absent from our traditional training (read: complete absence of business training in orthodontic residency). So, once we understand what leverage is, how do we apply the concept of leverage to the practice of orthodontics?

Personally, I do a lot of lecturing on Insignia and self-ligation and I use a lot of Invisalign in my practice. I’ve frequently heard the following comment, and I know that the people over at Invisalign hear it until they’re blue in the face. The comment from a vast majority of doctors is “I need to get X amount of dollars upfront to cover my lab costs before the patient can start.” For Insignia it’s usually north of $1,000, and for Invisalign it’s typically $1,800 or more because people think they need to cover their lab costs before starting treatment. As I will describe next, this thinking is a perpetuation of previous dogma and a blockade to the creation of leverage – and growth – in your practice.

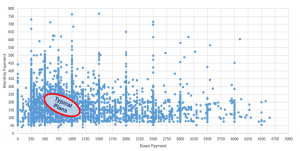

So, how do you intentionally create leverage in your orthodontic practice? Let’s first look at some data:

Each blue dot on the above chart illustrates the combination of monthly payment and down payment selected by a person who financed treatment (20+% of cases were pay-in-full, but not included here). Circled in red is the average range of what most people offer with their financial terms. On payment plans, most practices offer a 15-20% down payment with monthly payments that coincide with treatment time. Some add an additional menu option of a low or zero down option, and some offer 3rd party financing (e.g. Care Credit) for extended payment terms for those patients that can qualify. Many of us assume that our plans are tightly clustered in the typical plan circle because that’s what our patients want, but the truth is the plans are tightly clustered because that’s all we typically offer.

One of the amazing things we’ve proven about giving people open choice to pick their own terms is the surprisingly wide variety of terms people choose. What’s fascinating is that the scatter is far broader than we used to see when we tried asking them to tell us their desired down and monthly. There’s something about playing with their options and seeing the real-time impact on the variables. Notice above, 90% of dots are outside the ‘normal’ range, but more importantly that a large segment of the dots have down payments and/or monthlies well higher than what you would have offered on your fee sheet to begin with. For example, as you can see, someone actually picked $250 down and $740 per month. Another person selected $4,500 down and $50 per month. I would guess that few of you offer those terms as part of typical options presented, yet there are people who would choose them if offered. So, how do you use this information to create leverage?

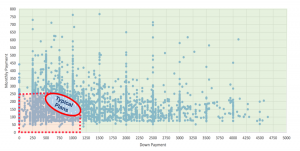

The area shaded in green represents the people who chose terms most orthodontists would consider favorable (to the orthodontist). Plans with a higher down and/or a higher monthly. What doctors typically do is pocket that money and consider it ours, even though we haven’t completed the treatment, yet we all get very itchy thinking of letting someone start treatment without covering our up-front costs. The federal reserve recently released a report that states 47% of Americans can’t handle an unexpected expense of $400 or more. The red-shaded section of the chart represents a large chunk of those people who need to put a lower amount down and a lower amount per month. So, it is safe to assume that if you are requiring more than $1,000 or $1,500 (or more) for a down payment you are intentionally choosing to keep that segment of people out of your office.

Now, I know what many of you are thinking: ‘I need to cover my lab bill before allowing someone to start treatment’. This outdated idea couldn’t be more flawed, short sighted, or expensive (to you). The only thing you are doing by charging a $1,500 down payment to begin treatment is stunting the growth potential of your practice and preventing you from earning more business (and by extension profit). As described in a previous post, the smarter philosophy would be to allow lower down payments and extended terms and charge interest where applicable to hedge your default risk. Rather than eliminate those people from your practice, open up your options to allow for surplus cash flow. Then simply take some of the extra money the people in the green shaded area give you and apply it to the lab bills for the people in red. Basically, by doing this, you create a blended aggregate cash flow. Voila! Leverage created. Sound too good to be true?

Using the philosophy described in this article is a large driving reason why OrthoFi clients average over 14% growth, and are able to sustain healthy cash flow over time. Across over 60,000 starts, OrthoFi’s average pay-in-fulls are 22%, average payment plan down payments at $834 and a total blended average same-day-cash (pay-in-fulls and downs) of $1,354. Creating leverage, rather than demanding an insurmountable down payment, is the key to making what you have go much further. The savvy business pros who read Entrepreneur Magazine know this. Dental Service Organizations (DSOs) who are getting bankrolled by and hiring those savvy business pros know this as well, and have grown 70% in the last 5 years based on a strategy of advertising very flexible orthodontic terms. It is time for orthodontists to utilize leverage as well before our restrictive terms drive more patients away from where they belong – in the hands of a highly skilled orthodontist.

UP NEXT: Key concepts and metrics to utilize leverage without ruining your cash flow.