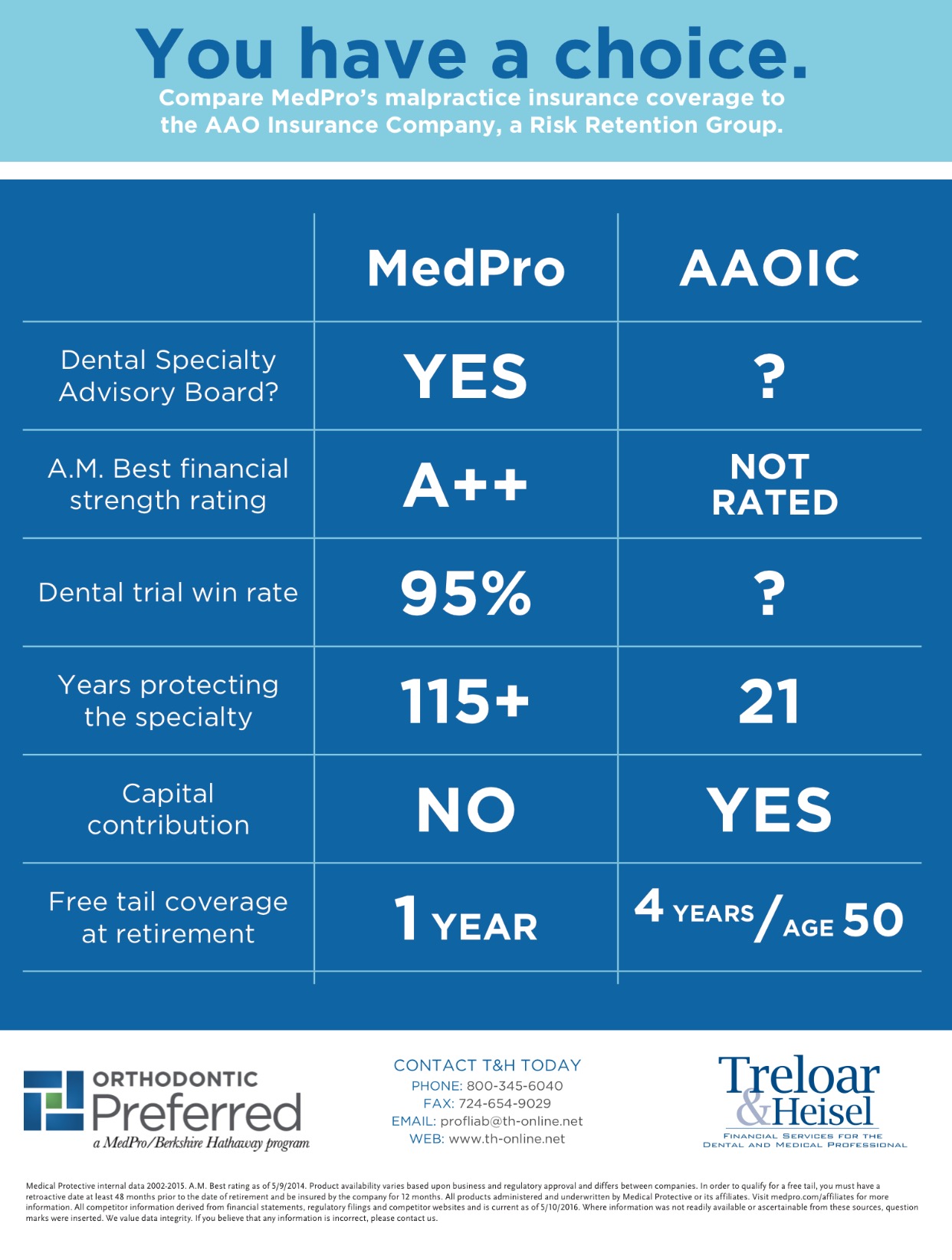

I hear disgruntled AAO members say often that they have to be AAO members because they need the AAOIC for professional liability insurance. This is simply not the case. Know your options. Look into MedPro when shopping rates and coverage and don’t forget to include your AAO dues when comparing premiums. Notice the part that says that MedPro will never settle a claim without your approval…

Hey Ben,

I saw your blog regarding the AAOIC Insurance Company and Medical Protective and wanted to respond with some facts. Thanks for providing a forum to clarify some of the misleading “marketing” that has been circulating for the last several years.

· Although MedPro may have a dental specialty advisory board, the AAOIC Board of Directors is comprised of nine orthodontic specialists and an Arizona Director who is a CPA with extensive insurance industry experience.

· All claims are reviewed by a panel of experienced orthodontists who help plan the best strategy for the insured, not the company.

· It is true that AAOIC has chosen not to have an A.M. Best rating. That is because all claims over $150,000 are reinsured with four companies rated A (excellent) to A++ (superior) by A.M. Best that have billions of dollars of assets to assure payment of any claims.

· The dental trial win rate is not really relevant without further information. Actually, orthodontic claims seldom go to trial if managed appropriately.

· AAOIC has been in business twenty-one years, and during that time, AAOIC’s only business has been insuring orthodontic specialists who are members of the AAO. AAOIC has significant reserves in addition to significant capital and surplus and will be here for the long haul.

· Yes, AAOIC requires a small capital contribution. That is because AAOIC is owned by its policyholders and not investors as with MedPro. Funds are returned to policyholders through premium reductions and dividends as opposed to the investors in a commercial insurance company. AAOIC has paid dividends to its insureds eight of the last ten years.

· AAOIC does not have a “consent to settle” provision. The policy clearly states that AAOIC will not settle without an insured’s consent.

All of these reasons are why the majority of practicing orthodontists in the U.S. have their malpractice insurance thru the AAOIC.

Thanks again,

Shawn Lehman-Grimes

Director, AAOIC

Thanks Shawn. I welcome the discussion. I think the AAOIC has some serious issues and has long rolled over clients and AAO members to do as they see fit. I don’t care which insurance company orthodontists choose, I just don’t ever want to hear that they “have to be an aao member so that they can use the AAOIC because that’s the only place to get the right kind of insurance”.

You print a Med Pro ad with misleading comparisons directly targeting AAOIC in an Orthopundit column with your caption that Med Pro is an excellent alternative to AAOIC but you don’t care which professional liability insurance company orthodontists choose?

I also allowed you and Shawn to comment. I don’t see the AAOIC giving equal time to dissenting opinions my friend.

Send me any dissenting opinions that you might have concerning AAOIC and I will assure you that the AAOIC board will receive them and listen. Constructive criticism is welcome. On another subject agree with on treating medicaid patients.

Mel I’ve made my issues with the AAOIC very clear starting with my pursuit of their use of the Hammer Clause years ago. I also don’t think that they will publish my dissenting comments on their website so you’re not really comparing apples to apples here. I appreciate your input and welcome future comments. So glad to hear you are on board with the access to care issue. Have a great holiday weekend!